tax benefit rule state tax refund

State tax refund of a decedent on Form 1041 and Tax benefit rule. Veterinary Tax Audit.

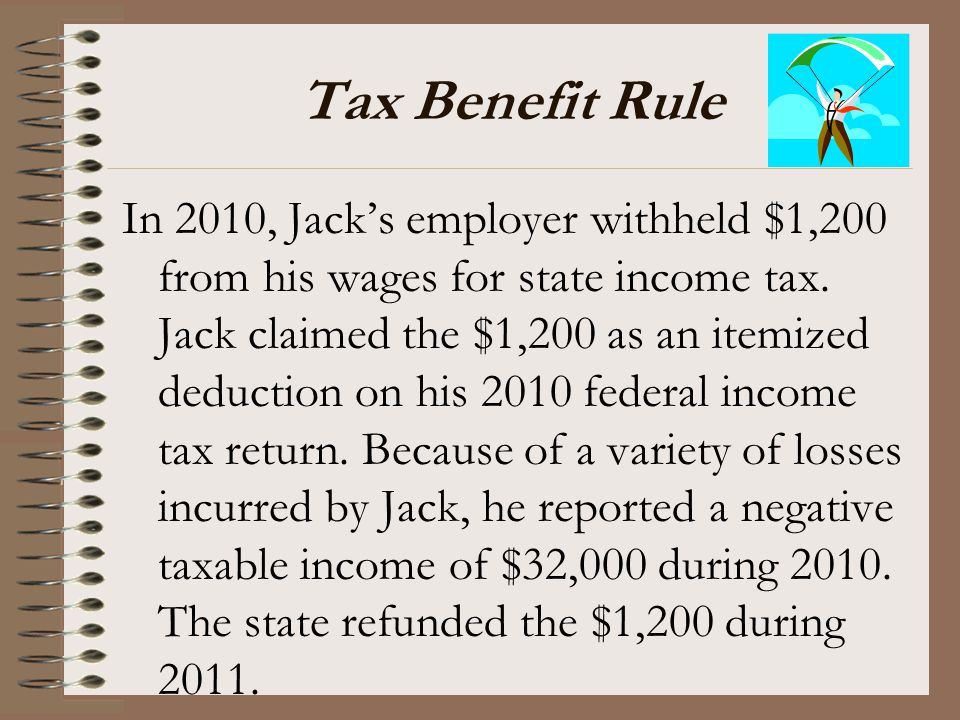

Therefore the taxpayer did not receive a tax benefit and 14323 of the 40000 is not subject to tax in 2001.

. 111 partially codifies the tax benefit rule which generally requires a taxpayer to include. In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the new SALT limit. The rule says if a refund can be linked to a prior deduction which the taxpayer.

It shouldnt but it is not programmed like the 1040. Whether state refunds are includable on a federal return depends on the tax benefit rule. The taxable refund for 2001 should be 25677 40000 14323.

500 of Cs state income tax refund in Cs gross income in 2019. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense resulted in a tax benefit. State tax refunds are reported to you on Form 1099-G.

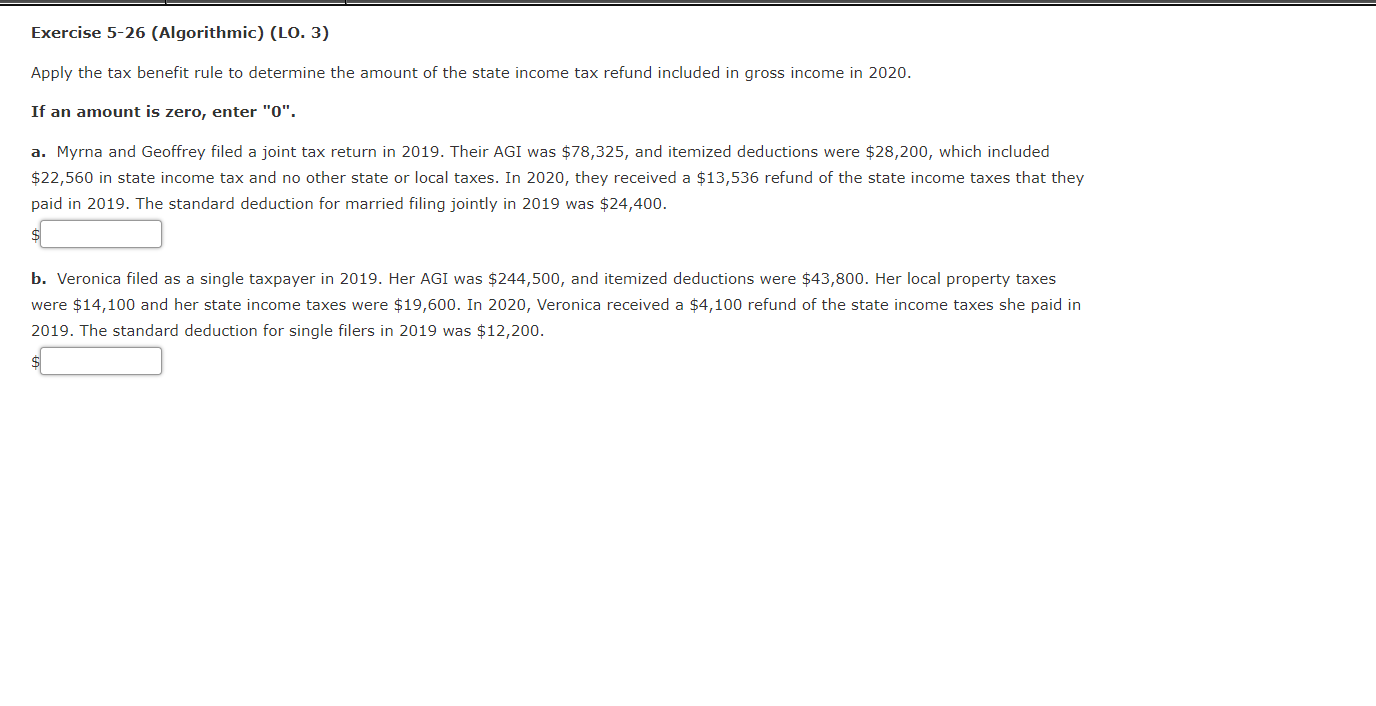

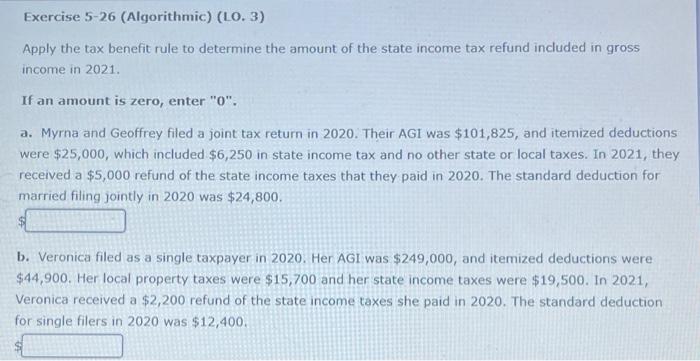

Let me try and parse this out from your numbers. Childcare Providers Tax Audit. If an amount is zero enter 0.

2019-11 issued on March 29 the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on deductions of state and local taxes to. Myrna and Geoffrey filed a. If inclusion of the refund does not change the total tax the refund should not be included in income.

Myrna and Geoffrey filed a joint tax. IRS Tax Audit Guides for the Self-Employed. Under the tax benefit rule the state refund is only deductible up to the point where you get a tax benefit from deducting it.

One common source that is frequently overlooked by tax advisors and more often misunderstood is the application of the tax benefit rule IRC section 111 to state and local tax. When the couple paid the excess refund 400 to the state in the prior year it increased their itemized deduction on their federal return to 14000 from 13600. However if total tax increases by any amount a tax benefit was received.

What is the Tax Benefit Rule. If your federal tax. In applying the AMT nonrefundable credits tax benefit rule to state income tax refunds the program assumes that if there was any tax benefit received in 20XX by deducting.

If an amount is zero enter 0. Audits In the Oil and Gas Industry. Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2022.

When a significant tax refund was. So the tax benefit you received from the 300 refund was only 225. Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2020.

Enter the refund as income then back it out As.

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Tax Documents Needed For Marriage Green Card Application

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Clarifies Tax Treatment Of State And Local Tax Refunds Redw

Solved According To The Irs Individuals Filing Federal Income Tax Returns Course Hero

Considerations For Filing Composite Tax Returns

Acct Test 2 Flashcards Quizlet

Solved Exercise 5 26 Algorithmic Lo 3 Apply The Tax Chegg Com

How To Get Your Maximum Tax Refund Credit Com

Solved Exercise 5 26 Algorithmic Lo 3 Apply The Tax Chegg Com

Investment Expenses What S Tax Deductible Charles Schwab

Unemployment Compensation May Be Tax Free For 2020 Gyf

61 Gross Income General Concepts And Interest Flashcards Quizlet

Guide To Filing Your Taxes In 2022 Consumer Financial Protection Bureau

Federal Review Of Income Received As A Refund Of Empire Zone Tax Credits Barclay Damon

2023 Standard Deduction Amounts Are Now Available Kiplinger

Latest Tax News Tips Resources

Acct 440 Welcome To Taxation Of Business Entities Dr Efrat Ppt Download

Income Tax Rules Committee Meeting Agenda Monday April 16 2012